Average Hunter

$276.00 Original price was: $276.00.$221.00Current price is: $221.00.

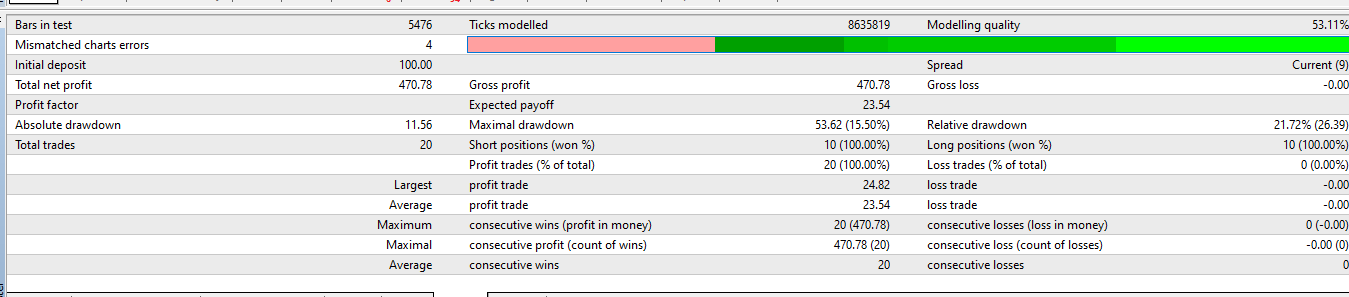

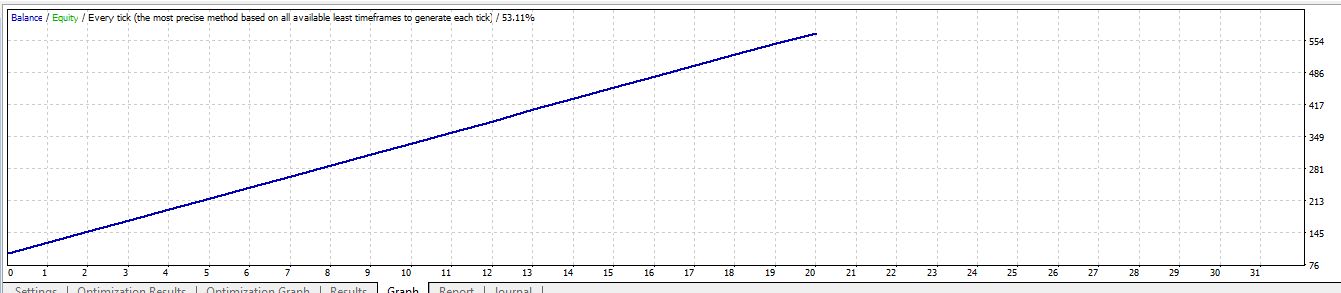

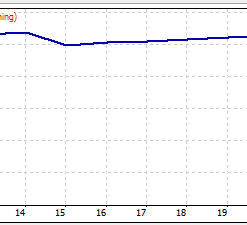

“Average Hunter” is a robust MetaTrader 4 Expert Advisor designed to leverage the reliability of EMA crossovers combined with ATR-based Trailing Stops for trend-spotting and profit maximization. With added RSI filters and calculated risk management, this EA aims to deliver a balanced trading approach, suitable for a range of market participants looking to capitalize on trend movements and volatility in forex markets. Back-tested and ready for forward testing, it’s a plug-and-play solution for traders aiming for systematic growth.

Disclaimer: This is not financial advice.

Out of stock

Introducing “Average Hunter” – your strategic ally in the fast-paced world of forex trading. This innovative Expert Advisor harnesses the power of Moving Average crossovers to dictate entry points, combined with an intelligent Trailing Stop mechanism based on the Average True Range (ATR), ensuring your trades lock in profits while managing risks dynamically.

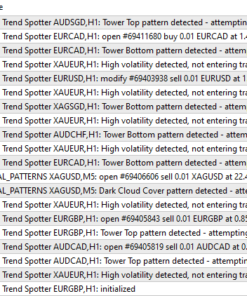

Crafted for the MetaTrader 4 platform, this EA uses a dual Moving Average (MA) system, engaging a fast and a slow EMA to pinpoint trend reversals with precision. When the fast MA sweeps above the slow MA, it’s a signal to go long; a cross in the opposite direction signals a short opportunity, providing a clear, actionable strategy that’s grounded in one of the most tried-and-tested methods in trading.

The “Average Hunter” goes beyond mere crossover signals. It integrates the RSI indicator to filter potential entries, ensuring you’re not buying into overbought conditions or selling into oversold ones. This additional layer of analysis aims to enhance the quality of trades and bolster the potential for sustained profitability.

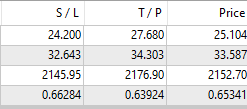

Equipped with a robust risk management protocol, this EA calculates lot sizes based on a predefined risk percentage of the account balance, ensuring that each trade is sized in proportion to your risk appetite. The innovative Trailing Stop feature dynamically adjusts stop loss levels in real-time, protecting gains as the price moves favorably, and stepping out when the tide turns, thereby striking a balance between securing profits and allowing room for price action.

Whether you’re an intraday trader looking to capture the volatility of the silver markets or a long-term trader seeking trend-following opportunities across forex pairs, “Average Hunter” is flexible enough to cater to a variety of trading styles and objectives.

With its straightforward approach, this EA is suitable for both novice traders seeking a reliable entry into algorithmic trading, and seasoned veterans looking to diversify their automated strategies. Back-testing results demonstrate its potential effectiveness, but as with any trading system, live forward testing is recommended to confirm its prowess in real-world conditions.

However, it’s important to remember:

- Backtesting with historical data and optimization are crucial to validate its effectiveness in different market conditions.

- Real-time trading involves risks, and past performance doesn’t guarantee future results.

- Consider incorporating your own trading style and risk tolerance beyond the EA’s logic.

Be the first to review “Average Hunter” Cancel reply

Related products

Algorithmic Trading

Algorithmic Trading

Algorithmic Trading

Algorithmic Trading

Algorithmic Trading

Algorithmic Trading

Reviews

There are no reviews yet.